-

FIN/SUM NEXT AI×ブロックチェーンが創る

2026.3.3-6 Marunouchi, Tokyo

新金融エコシステム

FIN/SUM NEXT — The New Financial Ecosystem Shaped

by AI and Blockchain

WHAT'S NEW

- 2026.2.13

- シンポジウム・ワークショップのプログラムならびにスケジュールが決まりました。

- 2026.2.11

- インパクトピッチの応募を締め切りました。たくさんのご応募ありがとうございました。

- 2026.2.3

- インパクトピッチに参加するフィンテックスタートアップの紹介ページを開設しました。2月11日(水・祝)17時まで 活躍を期待するスタートアップへの応援投票を実施しています。

- 2026.1.29

- 主な登壇者63名を掲載しました。

- 2026.1.28

- チケット販売・登録受付を開始しました。

- 2026.1.26

- インパクトピッチの応募を締め切りました。たくさんの応募ありがとうございました。

- 2025.11.28

- 公式サイトがオープン!インパクトピッチのスタートアップ応募も開始しました。

-

ABOUT イベントについて

FIN/SUM NEXT AI×ブロックチェーンが創る

新金融エコシステム FIN/SUM NEXT — The New Financial Ecosystem Shaped by AI and Blockchain2026年、FIN/SUMは10周年を迎えます。その節目に掲げるテーマが「FIN/SUM NEXT ー AI × ブロックチェーンが創る新金融エコシステム」です。

AIは、もはや特別な技術ではなく社会の前提となりつつあります。生成AIやエージェント型AIは、人間の判断や行動を補完し、経済活動のあり方を根底から変えつつあります。

またAIと並び、経済活動に大きな変革をもたらす存在が、ブロックチェーンの信頼性を核とする金融インフラです。透明で改ざんされないデータ基盤と、瞬時に価値を移転できるデジタルマネーやステーブルコインが結びつくことで、これまでにない価値を創出する新しい経済圏が生まれようとしています。

FIN/SUM NEXTは、AIとブロックチェーンが交差する地点から、次の10年の金融の進化を描く場です。AIネイティブ世代が生きる新しい経済社会において、金融は単なる「お金のやりとり」を超え、信頼と価値をつなぐインフラとして再定義されていきます。FIN/SUM NEXTはその変革を共に創るための、新たな出発点です。

-

-

日本のフィンテックの魅力を世界に発信し、フィンテックの更なる発展に向けたビジネス機会を創出するため、2026年2月24日(火)~3月6日(金)に「Japan Fintech Week 2026」が開催されます。開催期間中は、FIN/SUM2026を始めとして、各種団体が開催する多彩なフィンテック関連イベントが勢揃いします。

詳しくはこちら

CONTENTS コンテンツ

-

-

メイン会場となる丸ビルホールにて開催し、国内外の専門家、先進的な取り組みをする企業リーダー、スタートアップ創業者、政策当局者らによる真剣トークを展開。金融の未来に向けた取り組みや可能性、挑戦する様々な課題へのポジティブなソリューションを提示します。

SYMPOSIUMシンポジウム

-

-

シンポジウムで提示された課題やソリューションをさらに掘り下げ、小セミナー、ワークショップ、パネルディスカッション、ラウンドテーブルといったスタイルで、実践的なビジネスチャンスの方策などを提供します。

WORKSHOPワークショップ

-

-

自社の持つフィンテックのサービスや製品で、こんな社会課題を解決するといった、社会課題解決型のスタートアップの登竜門です。FIN/SUM2026では国内だけでなく、海外からの参加も含めて、幅広く参加者を募集します。

IMPACT PITCHインパクトピッチ

-

-

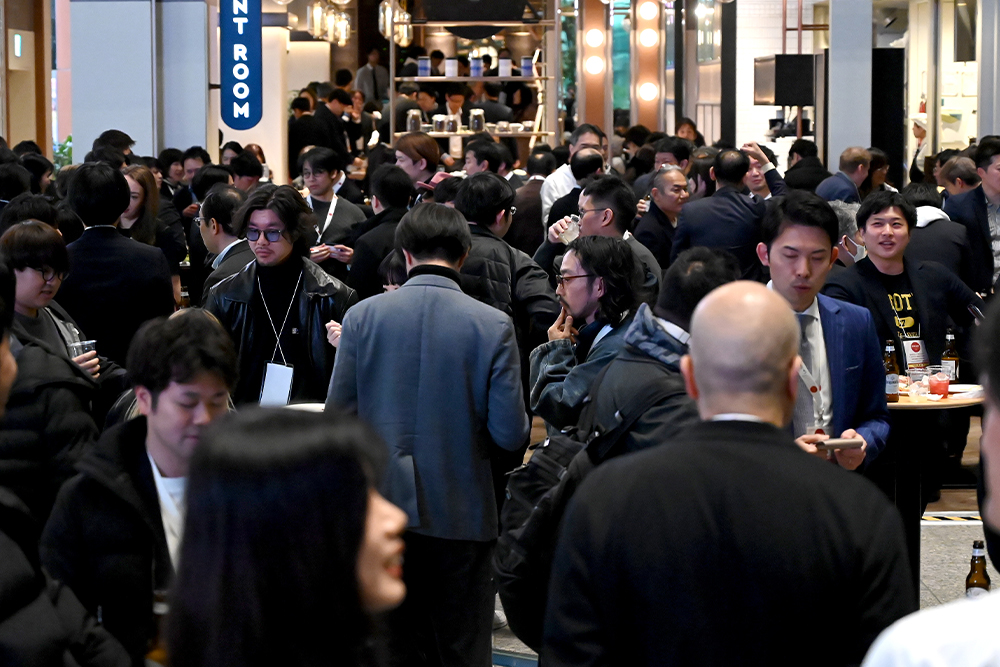

イベント会場だけでなく、丸ビル内のラウンジや1階のマルキューブなども来場者に利用してもらい、参加者が組織や国を超えたリアルなネットワーキングを楽しめるSUMシリーズならではの光景を目指します。イベント最終日の夜には来場者なら誰でも参加できるアフターパーティも予定しています。

NETWORKINGネットワーキング

-

-

メイン会場入り口への動線となるホワイエで展開する展示ブースでは、最新のものや、これから予定している製品やサービスを来場者に対面で説明。小規模ながら、リアル会場ならではのイベント体験を提供します。

EXHIBITION BOOTHSエキシビションブース

-

-

シンポジウムやワークショップと違って、テーマや内容によって参加者を限定し、録画やアーカイブ配信をしないラウンドテーブルを開催します。各国当局者や金融機関関係者などがフラットな立場で質の高い議論を展開し、課題解決や合意形成にあたります。多くは招待制とし、一般来場者は参加できない場合があります。

ROUNDTABLEラウンドテーブル

-

FIN/SUM 2025 DIGEST

FIN/SUM2025は「“真のマネタイズ”に挑む、次世代フィンテック」をテーマに2025年3月4-7日に東京・丸の内で開催しました。

日経 XSUM Channel

イベントの主なセッションと全体をまとめたダイジェスト版ビデオをご覧ください。少し長いので、倍速での視聴をお薦めします。

youtubeをみる

IMPACT PITCH スタートアップ大募集

Fintechで社会課題解決を目指す

スタートアップ、大募集!

FIN/SUM2026では、自社の持つフィンテックのサービスや製品で、こんな社会課題を解決するといった、社会課題解決型のスタートアップの登竜門となります。参加スタートアップは本サイトで公募、審査員やネットからの応援投票を経て、イベント会場にて最終選考社によるファイナルピッチを実 施します。世界的な社会課題解決とグローバル市場での展開をにらんだピッチとし、世界に向けて発信します。

- 賞金

- 最優秀賞の「日経賞」は100万円、 ほかに協賛企業による「企業賞」も設置予定です。

- 応募特典

- 一次審査に通ったスタートアップは、日経新聞朝刊のイベント前告知広告にて社名を紹介します。また、もれなくFIN/SUM2026の有料入場チケットを提供します。

最終審査で選ばれた社は、丸ビルホールで開催するファイナルピッチに参加できます。最終審査に残らなかったスタートアップにもプレゼンの機会の提供を考えています。

ファイナルピッチの模様と結果は4月中旬に日経新聞で掲載されます。

- 応募条件

-

- フィンテックを事業領域(※)としていること

- 創業10年以内、大企業の子会社ではないこと

- 調達資金額が1000万ドル以下であること

- 2026年3月6日にイベント会場にてピッチを行えること(ファイナリストに選択された企業のみ)

- イベント時のピッチに参加する交通費・宿泊費は自己負担となります

- 応募締め切り

2026年1月26日(月)17時(日本時間)募集は終了しました

- 申込み方法

- 画面下のエントリーボタンから必要事項を記入し、登録してください。

- お問い合わせ

- FIN/SUM事務局 [email protected]

※金融業界におけるデジタル化全般、決済プラットフォーム、レンディング(融資・資金調達)、投資・資産運用、デジタル通貨・暗号資産・NFT(非代替性トークン)、法人サポート業務、データガバナンス支援、保険のデジタル化、レグテックなどを指します。AIを活用したものももちろん入ります。

TICKETS チケット

来場チケットはテレワークできる場所も飲食も会場で可能。

ゆったりとしたイベント体験

- 来場チケット(有料)の方には、

丸ビル3階にあるTSUTAYAのシェアラウンジの1時間無料利用券を提供いたします。

- 定価

- 30,000円

- 10,000円

- 7,000円

- 50,000円

- 無料

- 無料

- 早割り

(2/24迄) - 10,000円

(1/29〜2/24迄) - 5,000円

(1/29〜2/24迄) - なし

- 20,000円

(1/29〜2/24迄) - なし

- なし

- 来場

- 可

- 会期中の

1日のみ有効 - 可

- 可

- 可

- 不可

- アーカイブ視聴

(1週間後から) - 可

- 可

- 可

- 可

- 可

- 可

- 早割り来場チケット(一般)General

- ¥10,000(税込み)

- 定価30,000円のチケットの早割価格での提供となります。(2月24日まで)

- すべての公開セッションに会場にて参加出来ます。

- 丸ビルで開催する公開セッションは日本語、英語の同時通訳付きです。

- イベント期間中、会場内では軽食や飲み物をご用意します。また、丸ビルおよび周辺施設にあるワーキングスブースなどの施設および丸ビルのTSUTAYA BOOKSTORE MARUNOUCHIのシェアラウンジを一定時間、無料でご利用いただけます。

- 3月6日のイベント終了後、丸ビル内で開催する夕刻のアフターパーティーに参加できます。

- 各セッションのアーカイブにてイベント終了の約1週間後から1カ月間視聴出来ます。視聴に必要な情報はイベントレジストサイトの「マイチケット」に掲載いたします。

- 早割り来場チケット(1DAY)1Day Ticket

- ¥5,000(税込み)

- 定価10,000円のチケットの早割価格での提供となります。(2月24日まで)

- イベント会期中の1日のみ有効で、その日のすべての公開セッションに会場にて参加出来ます。

- その他については一般チケットと同様となります。

- 来場チケット

(スタートアップ)Startup Ticket - ¥7,000(税込み)

- 起業10年以内のスタートアップ専用の割引チケットです。

- 3月6日のアフターパーティーにおいて、投資家とのミートアップの機会を設けます。

- その他については一般チケットと同様となります。

- 早割り来場チケット

(投資家)Investor Ticket - ¥20,000(税込み)

- 定価50,000円のチケットの早割価格での提供となります。(2月24日まで)

- スタートアップへの投資に携わる皆様に向けたチケットです。VCや事業会社のCVC、ファミリーオフィス、エンジェル投資家、LP投資家(年金基金、大学基金、機関投資家、富裕層など)などが対象です。

- 3月6日のアフターパーティーでは投資家専用席を設け、スタートアップとのネットワーキングにご活用いただけます。

- その他については一般チケットと同様となります。

- 来場チケット

(学生、学術、公務)Free Ticket - 無料

- 定員30名、先着順(定員になり次第、受付を締め切ります)

- 以下の方が対象となります。受付で証明書の提示が必要となります。

–教育機関に現役で在席している学生

–学術機関に現役で在席している方

–公務員または政治家など現役で公務に在職している方

- その他については一般チケットと同様となりますが丸ビルのTSUTAYA BOOKSTORE MARUNOUCHIのシェアラウンジの無料利用はできません。

- アーカイブ視聴チケットArchive

- 無料

- イベント終了から約1週間後アーカイブとして公開されたすべてのセッションを約1カ月間、視聴できます。

- このチケットでは来場できません。

FIN/SUM2026取材のためのプレス登録について

FIN/SUM2026はイベントを取材に公開しています。取材者は新聞社・出版社、テレビ、ラジオ、法人によるネットニュースまたは情報系サイトの編集者、記者、カメラマン、並びに以上のメディアと取材委託契約を結んでいる方が対象です。

なお、取材には、事前登録と主催者の承認が必要です。取材をご希望の場合は、事務局([email protected])までメールでご一報ください。 取材申込書をお送りいたします。

※取材概要を申請のうえ、主催者から取材許可が出た場合取材可能となり、改めて取材要項・注意点をお送りいたします。 ※アーカイブ配信のオンライン取材につきましても、事前の取材申請が必要になります。

OUTLINE イベント概要

- タイトル

- FIN/SUM NEXT

ー AI×ブロックチェーンが創る新金融エコシステム

- 開催日時

- 2026年3月3日(火) - 6日(金)

- 会場

- 丸ビルホール(丸ビル7F)

丸ビルコンファレンススクエア(同8F)

マルキューブ(同1F)

コンファレンススクエアM+(三菱ビル10階)

- 総合受付

-

マルキューブ(丸ビル1階)

マップを見る

※来場証をこちらでお渡しいたします。

- コンテンツ

- 講演、シンポジウム、ワークショップ、インパクトピッチ、ラウンドテーブル、展示など

*本イベントはライブでのオンライン配信はありません。オンライン視聴はイベント後のアーカイブ視聴のみとなります。

- 主催

- 日本経済新聞社、金融庁

- 特別協賛

- 三菱地所